Contents

A Fair Comparison

When considering Bitcoin mining investments, many look to popular hardware like the Whatsminer M50S, one of the most commonly used miners in the market. That is why we chose it as a benchmark for the purposes of this comparison, where we’ll evaluate how it performed against an investment in Infinity Hash Shares (IHS). While IHS offers several additional advantages, including lack of maintenance and ease of use, this article will focus solely on the hashrate and overall profitability achieved.

To provide a fair assessment, we will go back one year and compare the performance of one M50S miner against 3000 IHS. Both of these investments would have had a similar initial cost of $2,600 in August 2023, but their performance in terms of hashrate and returns has varied significantly.

Long-Term Growing Hashrate

When purchasing a miner, the goal is to obtain a constant hashrate until the machine either becomes obsolete or breaks down. For the Whatsminer M50S, this hashrate is approximately 126 TH/s. Infinity Hash shares have a different behaviour, as the hashrate backing them grows over time thanks to the constant addition of additional, and more efficient machines. Already in August 2023, the hashrate backing 3000 IHS was higher than that of the M50s at 146 TH/s. However, the growth of the hashrate backing IHS has grown enormously over the considered time period. As of now, 3000 IHS provide approximately 364.05 TH/s, nearly tripling their initial hashrate, while the M50S would have remained at 126 TH/s.

This impressive growth really showcases the power of Infinity Hash’s shares system and the reinvestment model. Through reinvestment, new machines are added to the mining operation without issuing additional shares. Meanwhile, the rising IHS prices allow Infinity Hash to purchase more machines while issuing fewer shares. Both of these have the effect of increasing the hashrate per share over time, and the results one year later are spectacular.

Value Retention and Liquidity

The evolution of the value of the investment also favors IHS. The M50S, like most mining hardware, depreciates over time due to factors such as technological advancements and wear. From its initial price of $2,600, the M50S is now worth around $1,500. In contrast, the value of 3000 IHS has appreciated significantly, currently standing at approximately $4,876. This increase is driven by the rising mining rewards and Bitcoin prices.

Furthermore, Infinity Hash Shares provide superior liquidity compared to physical mining equipment. Shares can be staked and easily traded on platforms like CoinEx or through decentralized exchanges (DEXs) on Solana, allowing investors to quickly adjust their positions. In contrast, selling a mining rig involves finding a buyer in the secondhand market, which can be a slow and uncertain process.

Earnings Potential: The Power of Reinvestment

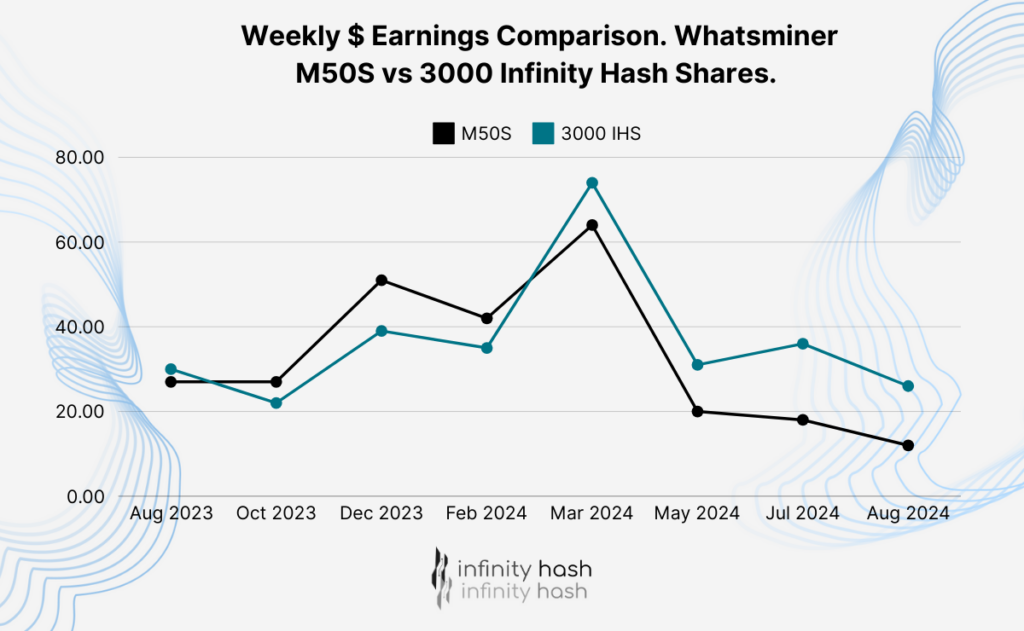

Weekly earnings are the clearest demonstration of the divergence in profitability between these two investment paths. Initially, both the M50S and IHS were generating similar weekly profits, around $27 and $30, respectively. However, the impact of the Bitcoin halving and Infinity Hash’s reinvestment model has led to a stark difference in earnings today. While the M50S’s weekly profits have declined to $12, the IHS continue to generate $26 per week.

This comparison is perhaps the most fair, and clearly shows the effect of the rising hashrate per share. Although the hashrate backing the shares has almost tripled, Bitcoin mining difficulty has also increased considerably over the last year. This has resulted in more moderate growth in weekly earnings, at least when compared to the huge rise in hashrate per share. Meanwhile, the static nature of the M50S makes it more susceptible to external pressures like rising mining difficulty and reward reductions (in particular, the Halving)

Conclusion

The profitability and hashrate comparison between the Whatsminer M50S and 3000 Infinity Hash Shares clearly demonstrates the advantages of IHS. Even obviating other factors such as the low time, capital and expertise requirements, and access to cheap electricity, the share system and the reinvestment model made IHS the superior choice over the last year. Moreover, since the reasons for such advantage in their performance will continue unaltered, it is expected that an investment in IHS will continue to provide better returns than simply buying a miner.